Famous financial commentator Willy Woo made a Bitcoin analysis that will be talked about again. Stating that the largest cryptocurrency is taking up more and more space in asset management portfolios every day, Woo claimed that if this rate increases in the future, the price will come to ‘at least’ $700,000.

“If $500 trillion came, a single BTC would be $24 million”

Stating that the value of all assets in the world is currently around $500 trillion, Woo said that if all this value flows to Bitcoin, the price of a single BTC will be $24 million, but this is impossible and used the following statements:

“The question is what will be the realistic allocation for everyone? Wealth management is very predictable, and money flows in a conservative manner according to known wisdom. BTC, even in this early phase of an asset class, Fidelity recommends 1-3% allocation, while we have seen numbers as high as 85% from BlackRock. If we assume 3% as a sensible allocation (and I note that was the number we used to share back in 2014!) then the lower bound of valuation is $700k. Of course, In today’s inflation adjusted numbers.”

“S-curve adoption may reach 16-50%”

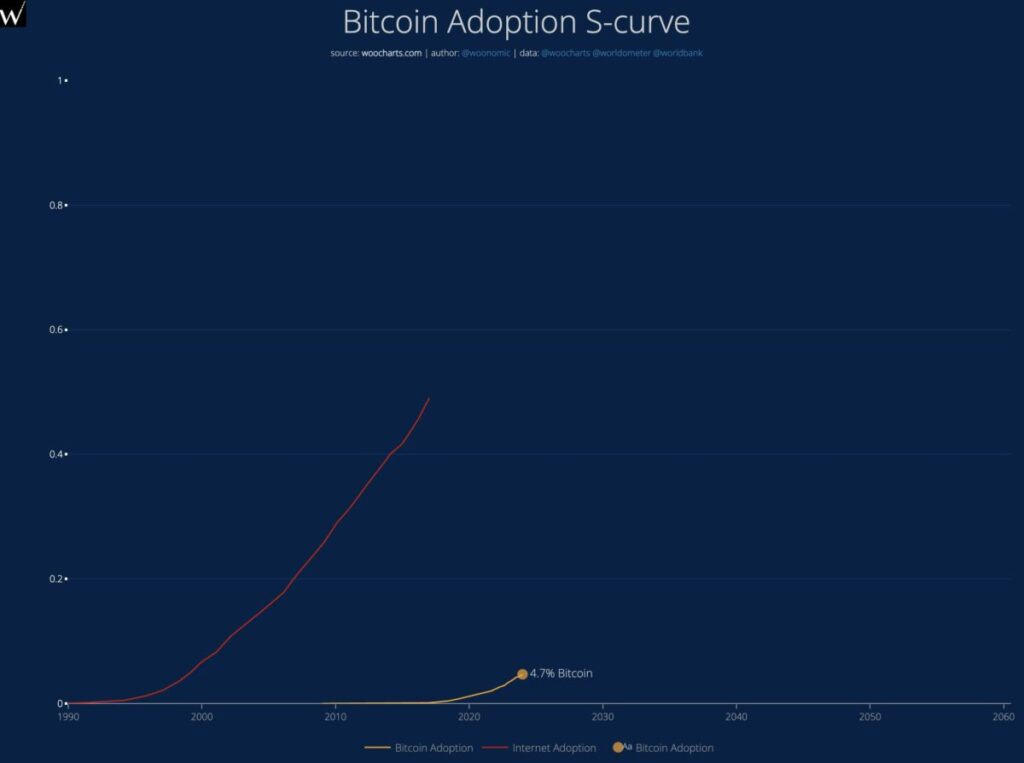

Regarding when Bitcoin can reach these levels, Woo, who gave the example of the S-curve followed for the adoption of technological and innovative developments, said:

“So now everyone is asking when. This is also a well known phenomena via the adoption S-curve. 16% is early majority, 50% is late majority. Wealth management is somewhere in this sector. So figure out when BTC adoption enters 16%-50% world adoption based on the yellow line….”

“Fiat money comparison ends”

Writing that there will no longer be any price comparison in a period when the Bitcoin price exceeds all fiat money values, Woo said, “After this inflection point, you’ll only be looking for investments that can beat BTC. For starters these are companies that store their profits in BTC. Saylor was the first pubco CEO to figure this out, but a LOT more coming.” he said.