The annual CPI data for July in the US came in at 2.9% and inflation fell below 3% for the first time in 3 years. The figures that came within expectations do not seem to have pleased the market. While Bitcoin fell by $2500, it went down to $58,800.

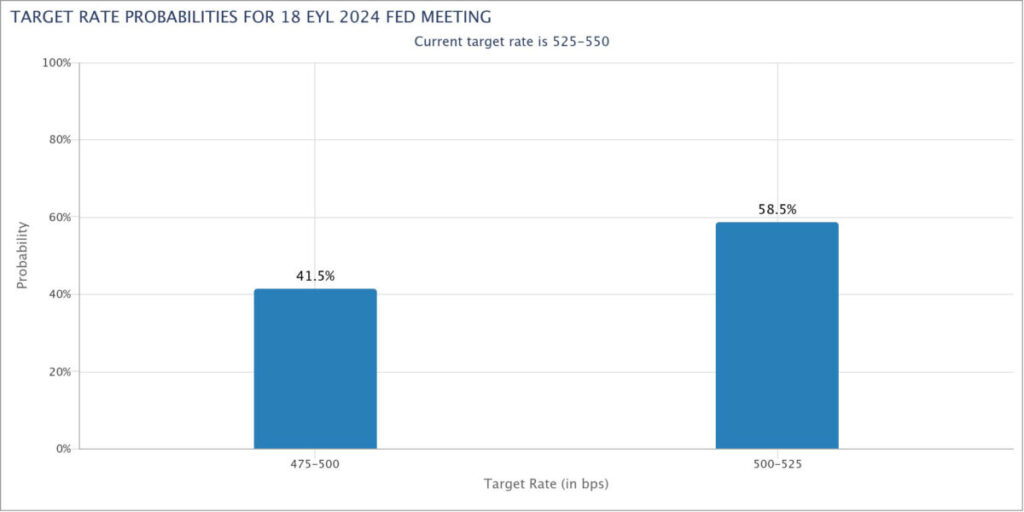

There is no expectation of 50 basis points

The biggest reason behind the decline seems to be the almost certain rate of interest rate cut by the Fed in September. The probability of a 50 basis point rate cut, which was priced above 50% before the inflation data, dropped to 41% after the release of the data. The possibility of a 25 basis point cut is priced around 58%.

This expectation did not only lower Bitcoin. US markets were also painted red. The S&P 500 fell below 5500, while the Nasdaq fell below 19 thousand. Tesla lost 2.6%, Coinbase 1.8% and MicroStrategy 3.3%.

There were also declines in gold and silver. An ounce of gold fell to $2450, while an ounce of silver is traded at $27.7.

Markets expect a 25 bps or 50 bps cut for September