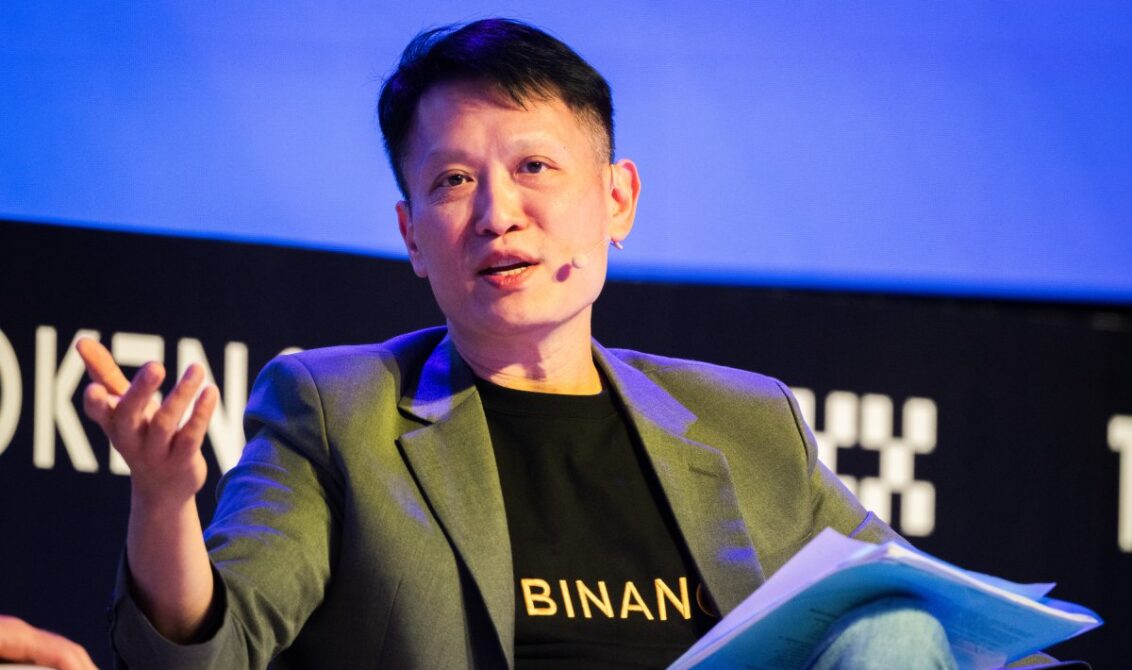

Binance CEO Richard Teng painted an optimistic picture of the future of the crypto and digital asset markets with possible interest rate cuts by the US Federal Reserve (Fed). Teng emphasised that the decline in interest rates could lead to significant increases in cryptocurrencies.

“Low interest rates increase liquidity”

Commenting on the issue, Binance CEO stated that low interest rates have always provided liquidity in the world and said the following:

‘We anticipate that the expected interest rate cuts will have a major impact on digital asset and crypto prices. Low interest rates provide liquidity to the financial system, which increases demand for high-yielding, risky assets such as crypto. For example, between February 2020 and February 2022, when interest rates were close to zero, Bitcoin rose 375%.’

“Concerns may lead to crypto”

Teng stated that he thinks that decreases in interest rates will be reflected not only in price increases but also in investor behaviour:

‘Lower interest rates may fuel inflation concerns, and this may lead some investors to cryptocurrencies to protect their purchasing power. Also, with the weakening of the dollar, more investors may consider digital assets as an alternative store of value.’

“Not only interest rate cuts…”

Binance CEO stated that the expectation of a rise in cryptocurrencies is not only related to interest rate cuts, but that halving and Bitcoin spot ETFs can also support increases in this period:

‘Bitcoin’s last halving event has historically led to price increases after 6 to 18 months. In addition, the introduction of spot ETFs can provide smoother transitions from stocks to crypto and allow increased liquidity to be directed to crypto markets with interest rate cuts.’

“September is already negative”

Stating that September was negative in cryptocurrencies, and the rises usually came in October, Teng also mentioned this historical statistic:

‘While September is usually a weak month for cryptocurrencies, prices usually start to recover from October. Expected interest rate cuts could give an additional impetus to this recovery. The impact of the Fed’s rate cuts on the digital asset market is uncertain, but indicators suggest that policy changes in September could be good timing for crypto investors. Lower borrowing costs and increased liquidity will offer a promising environment for cryptocurrencies. Historical trends and crypto-specific factors strengthen the expectation that these policy changes can trigger growth.’