Kaiko, which shares a wide range of analyses and statistics on cryptocurrencies, has published a new and sound report. The company evaluated cryptocurrency exchanges from various angles and ranked them according to certain criteria.

Some of the prominent details from the report, where many interesting statistics are shared, are as follows:

- 30% of the exchanges were established in the 2017-2018 period, when institutional and small investor interest in Bitcoin was high

- Only 34% of exchanges share their executive team fully openly

- 64% of exchanges offer rewards for finding system bugs or vulnerabilities

- 28% of exchanges do not care about market manipulation and do not have a monitoring system

- 20% of exchanges do not have KYC (identity) or AML (anti-money laundering) policies

- Binance has the highest volume and 30% of exchanges have an average monthly volume of more than $10 billion

Binance not in the top 3, OKX falls out of the top 10

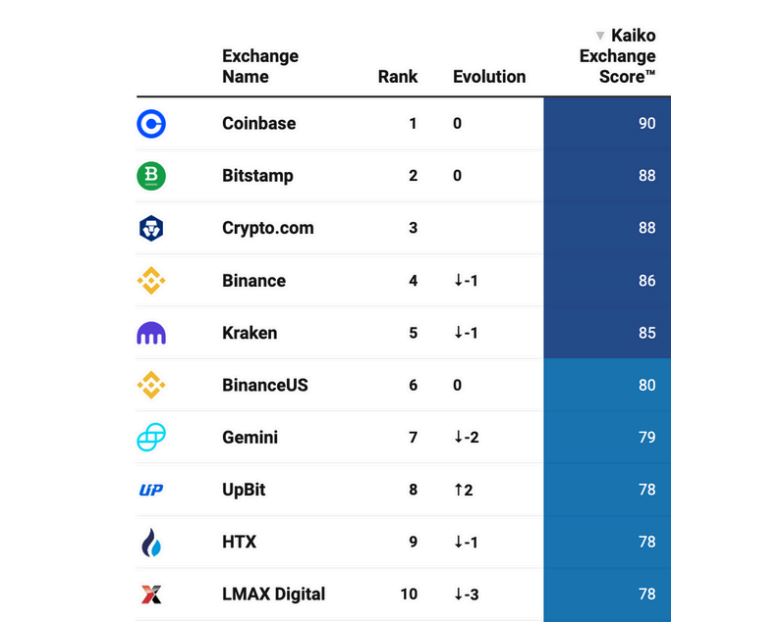

Kaiko determined 6 criteria in its ranking. These; governance, liquidity, technology, business activities, security and data quality.

While 43 exchanges were ranked in total, Coinbase ranked 1st. While Upbit, South Korea’s largest exchange, rose 2 places this quarter, the biggest share here was authentication and executive transparency. Mercado Bitcoin, one of the largest exchanges in South America, rose to the ‘B’ level, with security and technology improvements. OKX dropped from level ‘A’ to level ‘B’. The reason for this was the decrease in liquidity. Crypto.com reached the ‘AA’ level with its high volume and moved to 3rd place, ahead of Binance.

Bitstamp ranked 2nd with its developments in the field of technology and even surpassed Coinbase in this category. Coinbase, on the other hand, surpassed Bitstamp in a few more areas, especially liquidity, and ranked 1st.