When the US Federal Reserve (Fed) will start interest rate cuts and how much it will cut interest rates in 2024 remains the biggest question in the world markets. Fed reserve chairman Jerome Powell will face the press members after the interest rate decision announcement this evening and will both answer questions and make evaluations.

“Not in March,” he said

As it will be remembered, the Fed left interest rates unchanged at its meeting on 31 January. Interest rates in the US are at the highest level in the last 22 years (between 5.25% and 5.50%). In his statements in January, Powell stated that they would cut interest rates in 2024, but that March was too early for this application. Therefore, the markets do not expect a rate cut this evening.

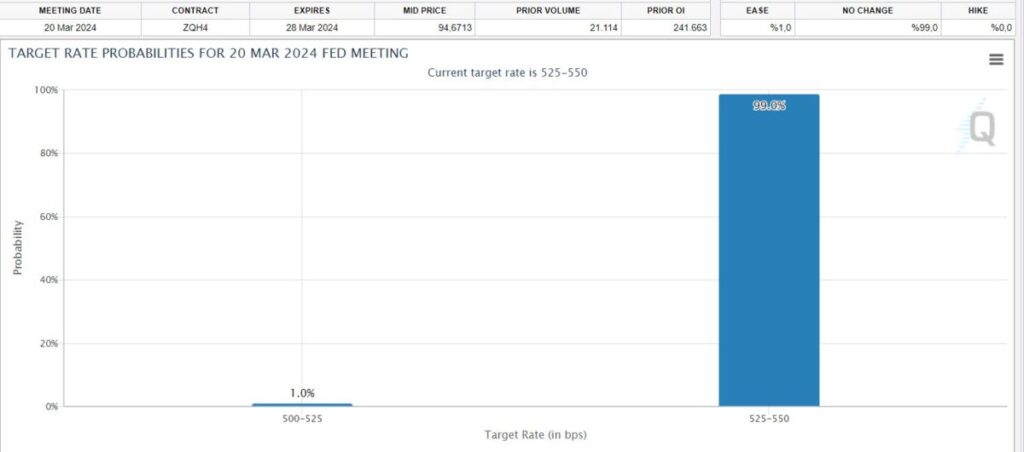

According to the “CME FedWatch Tool”, which uses the prices of futures fund contracts and is followed by analysts and economists to predict short-term interest rates, the institution will leave interest rates unchanged by 99% this evening. The probability of a 25 basis point decrease is seen as 1%.

On the other hand, markets expect an interest rate cut of 75 basis points for 2024. In the CME Watch Tool, the rate of cuts starting in June is seen as 63%. At the beginning of the year, the rate of starting interest rate cuts in March was much higher. However, higher-than-expected inflation data and Powell’s statement that “The numbers are not what we want” reduced this rate to almost zero.

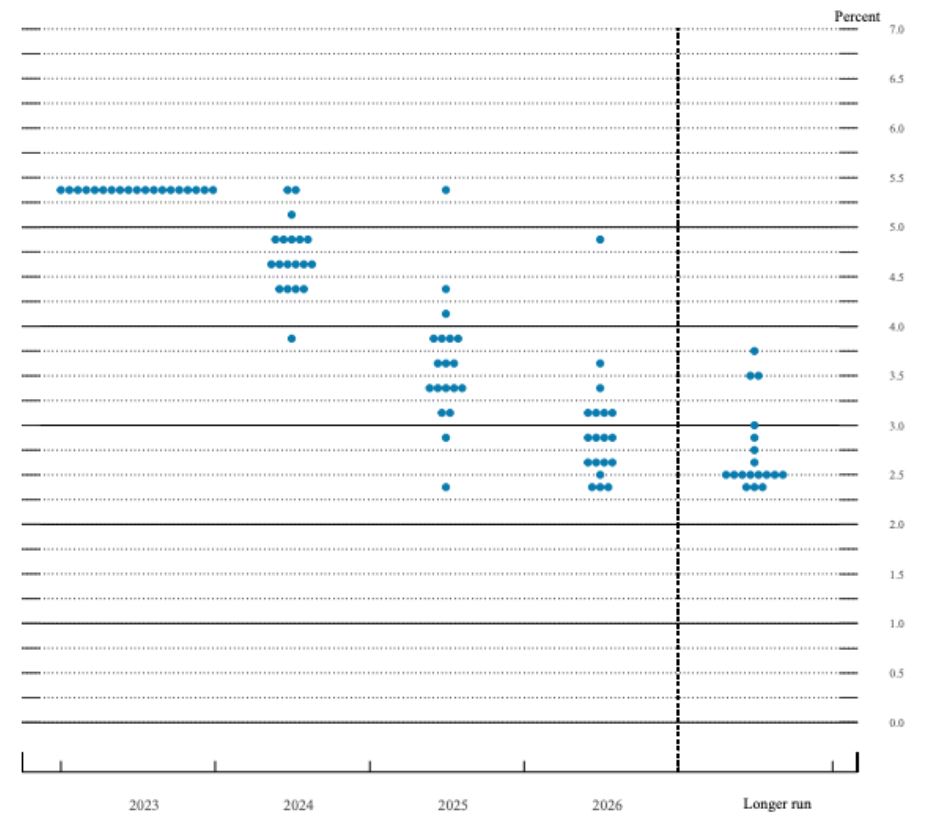

The new dot-plot will also be announced

A new version of the graph, also known as the “dot-plot”, in which Fed members and heads of Fed departments express their opinions on the course of interest rates, will be published this evening. In the last chart released in December, it is seen that many members expected interest rates to fall below 5% or even 4.5%. Where this figure will be this evening is also a matter of curiosity… The dot-plot chart is released only 4 times a year.

As it is known, the Fed states that it is struggling to bring inflation in the US down to 2%. Although some analysts find this figure too low, Fed chairman Powell has always stated that they want to see a 2% inflation rate permanently.