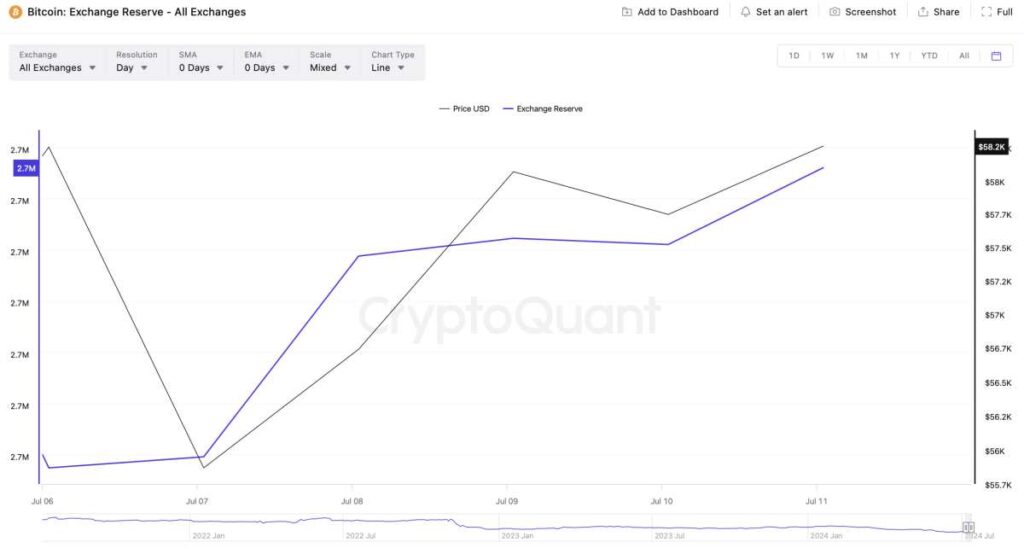

According to on-chain data platform CryptoQuant, Bitcoin reserves on exchanges have increased significantly since last week. Analysts attributed the drop in bitcoin price not to the sale by the German government, but to increased transactions by short-term investors on exchanges.

Up 0.5% since Saturday

According to CryptoQuant data, the number of bitcoins on exchanges last Saturday was 2,767,490. Since then, however, it has increased by 0.5 percent to 2,779,197. Although experts do not believe it has a direct impact on the declines, indirectly, the German government’s sales and Mt. Gox’s large number of BTCs are some of the major reasons for the increase in the number of Bitcoins entering exchanges.

Julio Moreno, chief research analyst at CryptoQuant, said in his assessment on the subject that bitcoin reserves have increased, especially on the Binance, OKX and Bitfinex exchanges, and said:

“Most of the trading activity comes from short-term investors. There is no direct link to the German government’s sales”.

The German government is known to have reduced the 50,000 bitcoins it held to less than 10,000, especially with the intense selling in recent days. These remaining BTCs are expected to be completely sold by next week. Mt. Gox’s bankruptcy administration still has more than 90,000 Bitcoins waiting to be distributed.