As Bitcoin breaks records every day, interest in ETFs continues to grow. While it is a matter of curiosity how far the rises will continue, CryptoQuant CEO Ki Young Ju made an important claim on the subject.

“Bears can’t win this game”

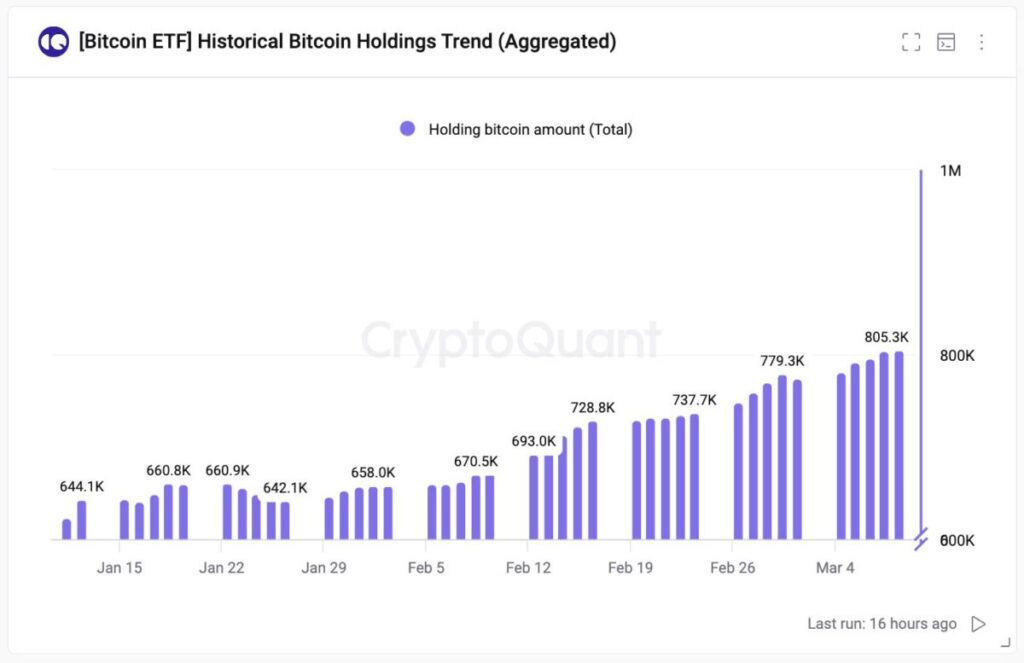

Young Ju said in a comment on X that ‘bears’ cannot win this game unless the demand for Bitcoin spot ETFs ends:

“Bears can’t win this game until spot Bitcoin ETF inflow stops. Last week, spot ETFs saw netflows of +30,000 BTC. Known entities like exchanges and miners hold around 3 million BTC, including 1.5 million BTC by US entities. At this rate, we’ll see a sell-side liquidity crisis within 6 months.”

“Next cyclical top may exceed our expectations “

Stating that Bitcoin is in a price discovery zone, Ki Young Ju said, “Once a sell-side liquidity crisis happens, its next cyclical top may exceed our expectations due to limited sell-side liquidity and thin orderbook.”