Bitcoin, which reached its historical peak of $73,000 in March, continued its volatile movements and fell below $61,000 over the weekend. Bitcoin’s decline, on the other hand, almost shattered altcoins. It is estimated that some people or institutions made significant purchases during this sharp decline.

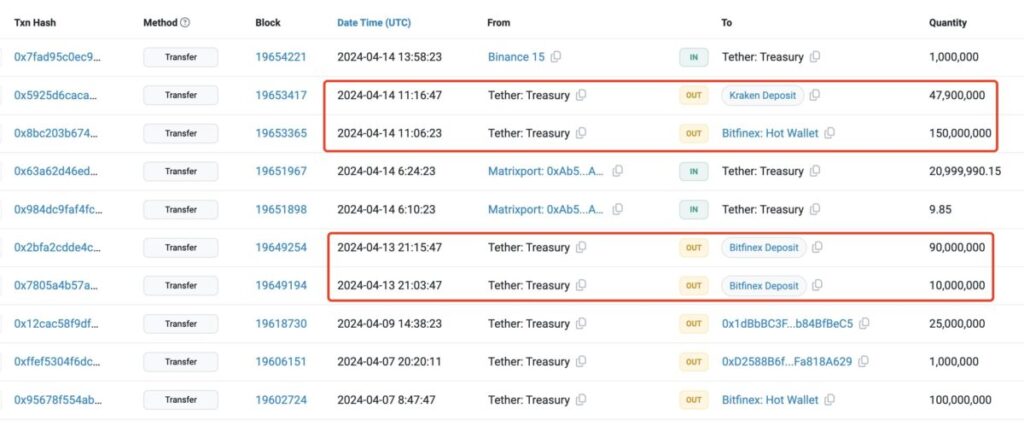

300 million USDT to two exchanges

According to the information shared by on-chain tracking platform Lookonchain, a total of $297 million USDT was transferred from the Tether Treasury to the Bitfinex and Kraken exchange on Saturday and Sunday, when there was a major price decrease. It was also noteworthy that the market started to recover after these transfers.

As it is known, the Tether Treasury holds the tokens of large individuals and institutions holding USDT. These wallet holders, who share KYC information with Tether, can sometimes demand real US dollars from the company in exchange for their USDT. Therefore, it is very likely that these account holders who make purchases are from large fund firms…

The intelligence that Iran would launch a missile and drone attack on Israel was reported by global media institutions on Friday evening, and the expected attack took place on Saturday night. This action caused one of the fastest and sharpest declines in cryptocurrencies in history. Bitcoin fell nearly 10% in a 1-hour period and fell below $61,000.

The Tether Treasury holds the token of large individuals and institutions holding USDT.

These wallet holders, who share KYC information with Tether, can sometimes demand real US dollars from the company in exchange for their USDT.Therefore, it is very likely that these account holders who make purchases are from large fund firms… The intelligence that Iran would launch a missile and drone attack on Israel was reported by global media institutions on Friday evening, and the expected attack took place on Saturday night. This action caused one of the fastest and sharpest declines in cryptocurrencies in history.Bitcoin fell nearly 10% in a 1-hour period and led to an increase in the number of transactions in the US dollar.

The largest cryptocurrency, which rose above $64,000 again on Sunday, first exceeded $65,000 early this morning, and then surged above $66,000 with the news of the Hong Kong ETF.