While Bitcoin continued the upward movement it started last week on the first day of the new week, the cryptocurrency researcher company Kaiko also evaluated the market.

In Kaiko research, the current market value of USDT was questioned, while it was stated that the whales are still waiting and many levels in the 2021 bull are still not caught:

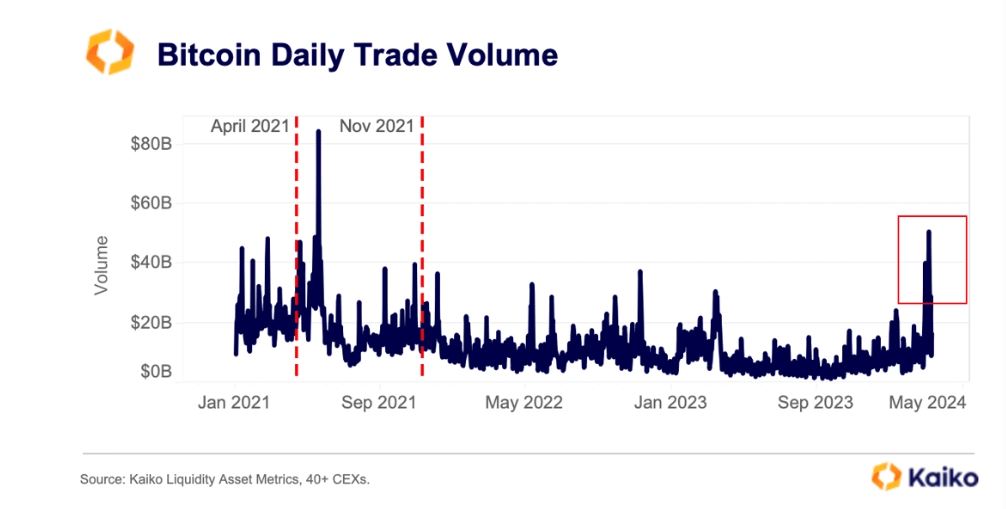

Spot and derivative volumes hit records

Last week, as Bitcoin hit new records in a week, strong volumes also followed. On 5 March, Bitcoin spot trading volume reached $51 billion. This figure was one of the highest levels in recent years. The last time volumes reached this level was in November 2021. Bitcoin reached its peak of $69 thousand at that time. Like spot trading volumes, the derivative side was also active. While very large liquidations were seen, the open position value in Bitcoin perpetual futures increased by $2 billion on 4 March and reached $15 billion, the highest level in recent years. The figure fell by $1.4 billion just one day later. Although funding cost rates have fallen from peak levels, it is worth noting that they are still very high.

“As prices rose, the money entering the stock markets increased”

When we look at all these, we see that as prices rise, the money and liquidity entering the stock markets also increase. This shows us that there is actually a healthy and reactive market. It is also worth mentioning that there are some profit realisations among these reactions.

“Whales may be waiting this time”

Despite the rise in prices, we see that on-chain whales are making a slow comeback. Through the Wallet Data program, where we have been following millionaire wallets on a daily basis, we have seen that the number remains below 2000 per day. In the last bull season, this figure was 4000 per day. More than 2000 wallets were reaching a daily value of $10 million at that time. In 2021, there was a very serious flow of money in every way, but this time the whales want to see if the market will continue in the same way and seem to be cautious.

“It is not clear why Tether’s market capitalisation is high”

One of the most important developments of the past week was the USDT market capitalisation of $100 billion. With the increase in cryptocurrency prices, USDT volume on centralised exchanges also increased. However, the volume remained well below the $661 billion captured in May 2021. Therefore, it is not entirely clear why USDT’s market capitalisation is $30 billion more than 2021 levels. In addition, although USDT’s market capitalisation is at an all-time high, its market share in terms of trading volume has declined compared to the 2021 bull season. This rate, which was 95% at the end of 2020, has now dropped to 71%. The real winner here seems to be FDUSD, backed by Binance.

“Volume of meme tokens also hit a volume record”

The rise in meme tokens was also one of the important developments that also marked the week. The transaction volume reached $80 billion, the highest figure in recent years. SHIB was at the top in this sense with $31 billion. DOGE, the largest in the market, remained in second place with $23 billion. PEPE, which increased sharply, reached $14 billion, and Solana-based BONK reached a volume of $5 billion. The meme coin craze also increased transaction fees on the Ethereum network to a 2-year high.