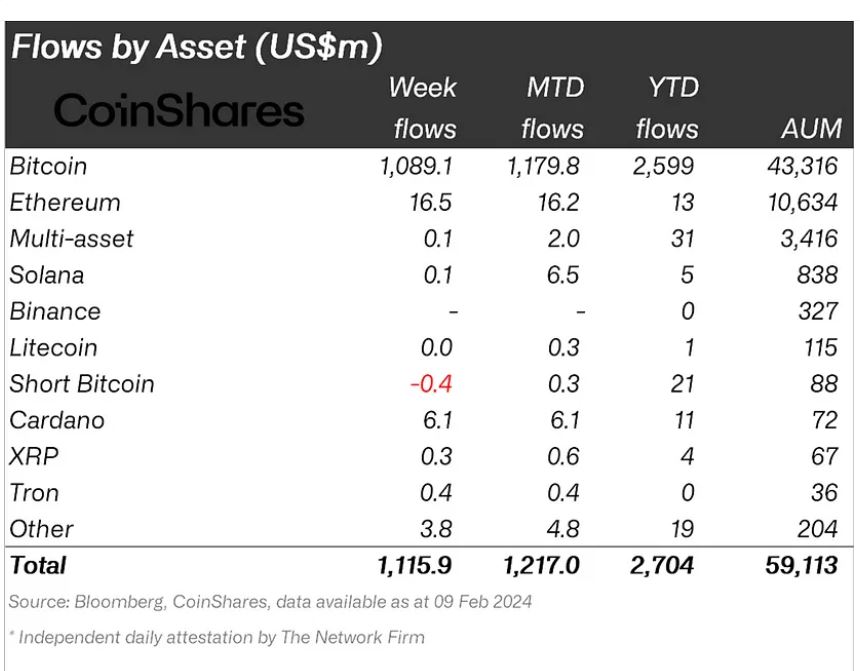

Last week, there was a considerable increase in requests for digital asset investment products. The net amount since the start of the year increased to $2.7 billion as a result of inflows of $1.1 billion. From the beginning of 2022, this amount has never been seen.

$6.1 million to Cardano funds!

Bitcoin funds accounted for 1,089 percent of the $1.1 billion in net inflows. There were total investments of $16.5 million in Ethereum funds, $100,000 in Solana, $400,000 in TRON, and $300,000 in XRP funds. In this regard, Cardano (ADA) funds had the most inflows. Cardano funds received an unprecedented weekly investment of $6.1 million since last year.

There was a $400,000 outflow from short-Bitcoin funds that had invested in Bitcoin’s decrease.

Even though it was obvious that almost all of the investments were made in the USA, the total amount was $1.108 billion. Switzerland had the closest fund inflow to the United States, with only $39 million.