As the bull season in cryptocurrencies continues at full speed, Bitcoin said “Hello” to $69,000 again yesterday, for the first time since November 2021. However, this meeting was short-lived and the largest cryptocurrency then fell to $59 thousand.

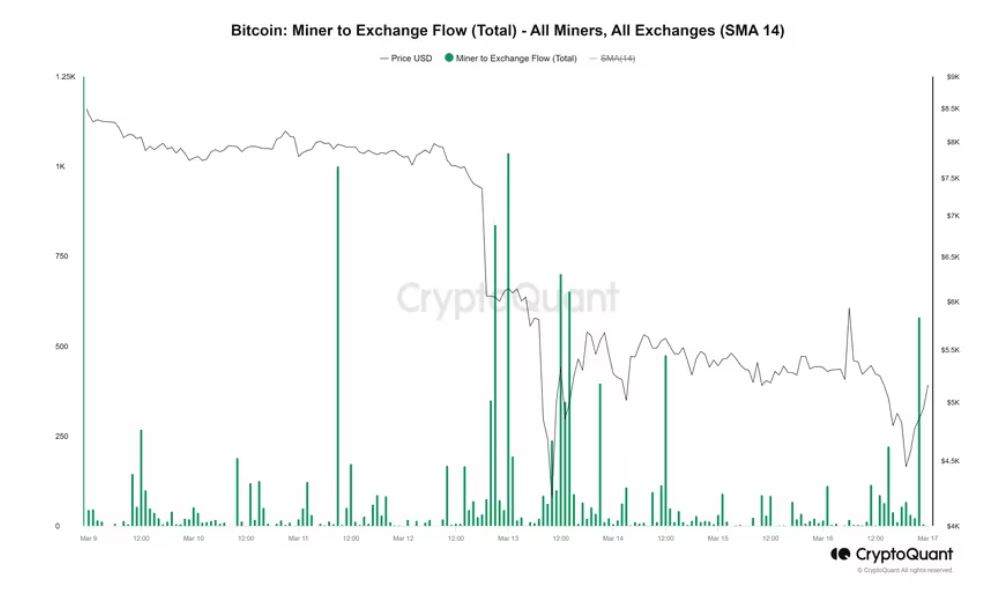

$69 million sell-off from old miners

On-chain data shows that behind the decline are the sell-off made by some accounts that are at least 10 years old. According to the information provided by CryptoQuant; Some accounts that were mining in 2010 transferred 1000 Bitcoins worth $69 million to the Coinbase exchange at the peak moments and made profit realisation. This caused the sell-off to be more severe than it should have been. There is also the possibility that these accounts belong to a person or organisation that manages multiple accounts.

As it is known, the transfer of coins that have not moved for many years and “sleeping” causes the market to experience more selling pressure and sometimes even panic. Experts state that traders open “short” transactions, especially at ATH levels, and the introduction of such old coins increases the number of these transactions.

In the chart below, which shows the movements of Bitcoin miners, it is noteworthy that miner transfers increased sharply yesterday.

Bitcoin, which continued its decline movement up to $59,000, then managed to recover again. The largest cryptocurrency is trading around $67,200 on Wednesday morning hours when the news was written.