There is now less than a week left until the halving of Bitcoin’s reward, which happens automatically every 4 years. While the big companies, whose share values have fallen significantly recently, are adding machines that consume less electricity but have more “hash rate” ower to their inventories, they are making plans to get out of this situation with the least damage.

According to Bloomberg, the losses of mining companies after the halving of the reward may exceed $10 billion, according to the US media. It was also written in the news that both large and listed companies such as Marathon Digital, RIOT and Cleanspark have made large investments and want to enter this situation in the most ready way by acquiring small companies that are competitors.

“This is the final push for miners”

Speaking to Bloomberg, CoinShares analyst Matthew Kimmell said that miners are now firing their last bullets on the subject and used the following statements:

“This is the final push for miners to squeeze out as much revenue as they can before their production takes a big hit. With revenues across the board decreasing overnight, the strategic response of each miner, and how they adapt, could well determine who comes out ahead and who gets left behind.”

They reached $20 billion in value

Bloomberg also noted that miners have been using sophisticated machines since 2013, and according to JPMorgan’s latest report, the total value of 14 listed mining companies in the US has reached $20 billion. While US mining firms are currently the face of the industry, they account for only 20% of the world’s computing power. While there is still a significant number of individual miners, according to crypto research firm TheMinerMag, their job is about to get a lot harder. Companies listed on exchanges can borrow and raise money through share sales, but the rest will need either investment or loans.

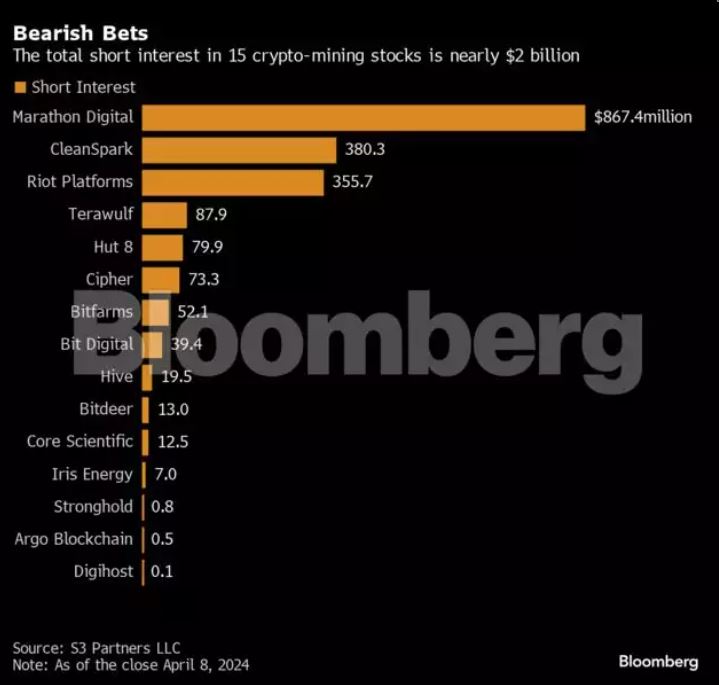

$2 billion short position

The value of short positions in mining stocks, which have already been lagging for some time, is around $2 billion. According to Ihor Dusaniwsky, director of investment analysis firm S3 Partners, this $2 billion short position value corresponds to 15% of the total market capitalization of the companies. A giant short position of $867 million in Marathon Digital is also not going unnoticed.

The explosion came months after the last halving

While halving rewards increases miners’ costs and reduces their earnings, it always has a positive effect on the price of Bitcoin. For example, about 6 months after the last halving in May 2020, Bitcoin began a sharp upward movement. Bitcoin, which was around $9,000 in May 2020, peaked at $64,000 (at the time) in April 2021, about a year later.

With fewer Bitcoins entering circulation, the already limited supply of Bitcoin has always made it a more valuable asset. Therefore, even though miners’ costs are increasing, the rising Bitcoin price seems to compensate for this situation.

At the time of writing, Bitcoin is trading above $66,000.