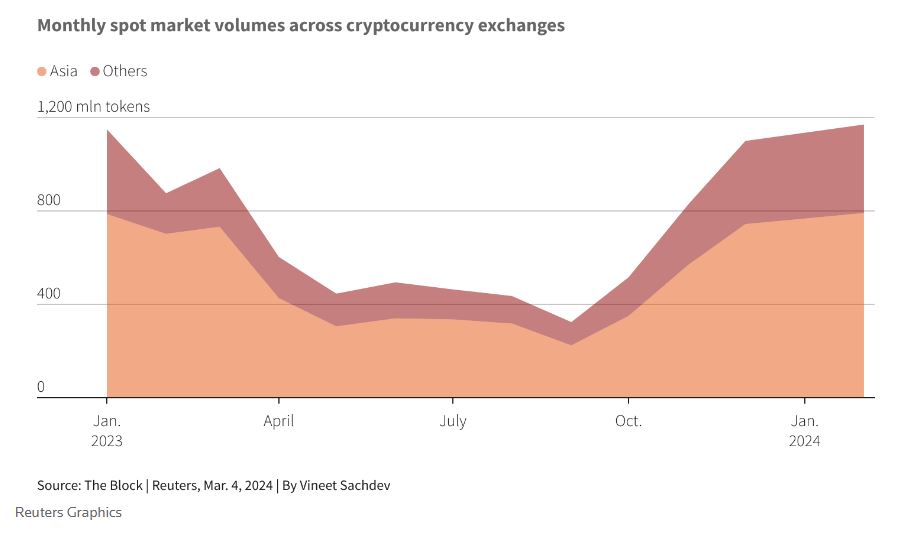

Bitcoin’s sharp rally, according to many, is behind the American investors who bought US spot ETFs, while Reuters, reporting the data it received through The Block, stated that Asian investors were behind the rises, especially in February.

In the news of the agency, it was written that $791 billion of the $1.17 trillion Bitcoin value in February, or approximately 70%, came from Asia, while $113 billion of the figure belonged to the North American region.

“Small investors frustrated with an anaemic stock market”

In the news of Reuters, it was also stated that “In China, FOMO has gripped many small investors frustrated with an anaemic stock market. On popular messaging app WeChat, searches for “bitcoin” jumped 12-fold in February.”

“They also invested $6.89 million in Proshares Bitcoin Strategy ETF”

Spot bitcoin ETFs are banned in South Korea, but local brokers offer easy access to bitcoin futures ETFs, according to the report:

“South Koreans have made a net investment of $23.4 million in the U.S.-listed 2X Bitcoin Strategy ETF this year, compared with $25.1 million in all of 2023, according to the Korea Securities Depository. In February, they also invested $6.89 million in Proshares Bitcoin Strategy ETF.”

According to the statement given by Reuters based on Kaiko data, the great power of Binance, Coinbase and Bitstamp in Asian markets also facilitates purchases from this region. In India, the Kucoin exchange, like Binance, also stands out. It is also reported that Kucoin does not charge users the 1% 1% transaction monitoring tax charged by local operators, so it appeals to a serious crowd in India.