The Fed, which entered the monetary tightening period with a 25 basis point rate hike in March 2022, officially ended this course after about 2.5 years. The Fed, which has kept interest rates constant for 1 year and has not cut interest rates for 4.5 years, made the entry with a 50 basis point cut.

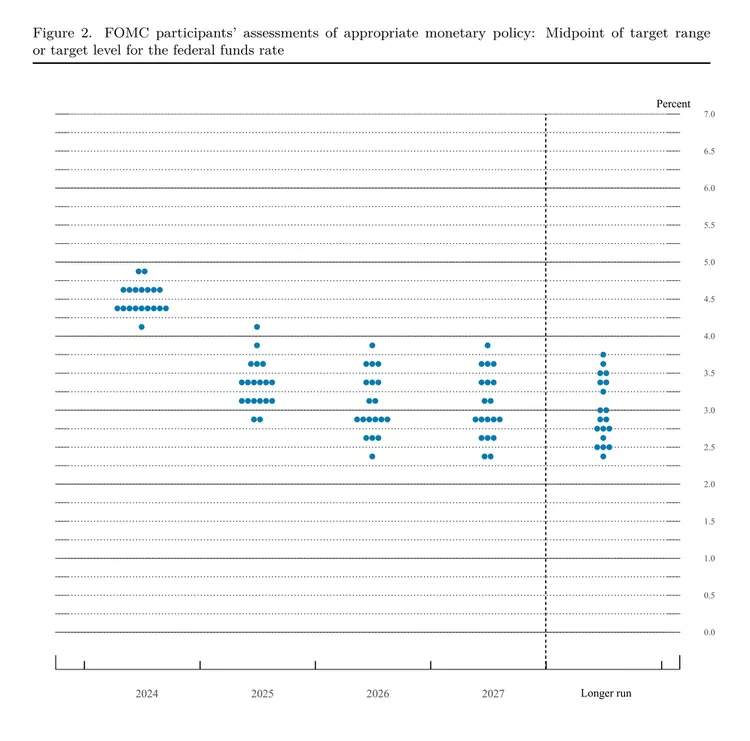

What does the dot-plot say?

While the majority of Fed members expect further cuts in the rest of 2024, they think that these cuts should continue in 2025. Among the members who expect interest rates, which are currently in the range of 4.75%-5.0%, to fall further;

- 7 of them 25 basis points,

- 9 of them 50 basis points,

- 1 thinks that an additional 75 basis points should be cut.

- 2 members are of the opinion that there should be no further cuts this year…

Further reductions expected in 2025

Members’ expectations for 2025 are also important… Total interest rate cut expectations for next year are as follows:

- 1 member 75 basis points

- 1 member 100 basis points

- 3 members 125 basis points

- 6 members 150 basis points

- 6 members 175 basis points

- 2 members 200 basis points

10 members think that it should fall below 3% in 2026.