US non-farm payrolls and unemployment data for August, which will directly affect the Fed’s interest rate decision on September 18, will be released today at 03:30 p.m. Expectations are that around 161 thousand people joined the labour market last month and the annual unemployment rate fell to 4.2% (from 4.3%)…

What happens if it comes much lower?

As is known, the Fed has been implementing a policy of monetary tightening and keeping interest rates high for about two years. However, the recent lower-than-expected data triggered fears of recession in the US. If the employment figures come in lower than expected today, the possibility of a 50 basis point cut by the Fed on September 18 may increase.

July was a surprise

As it will be remembered, the employment figure, which was expected to be 185 thousand in July, was 114 thousand and the fears of recession in the US emerged for the first time in this period. Unemployment was also announced as 4.3%, again above expectations. This rate was also the highest unemployment rate since October 2021.

Manufacturing and JOLTS also came in low

Two data releases in the US this week were indicative of a serious cooling of the economy. The Manufacturing Purchasing Managers’ Index (PMI) on Tuesday and the number of open jobs, known as JOLTS, on Wednesday came in significantly below expectations. The markets, which fell after the announcement of the PMI data, welcomed the fact that the JOLTS data came lower than expected a day later.

50 or 25?

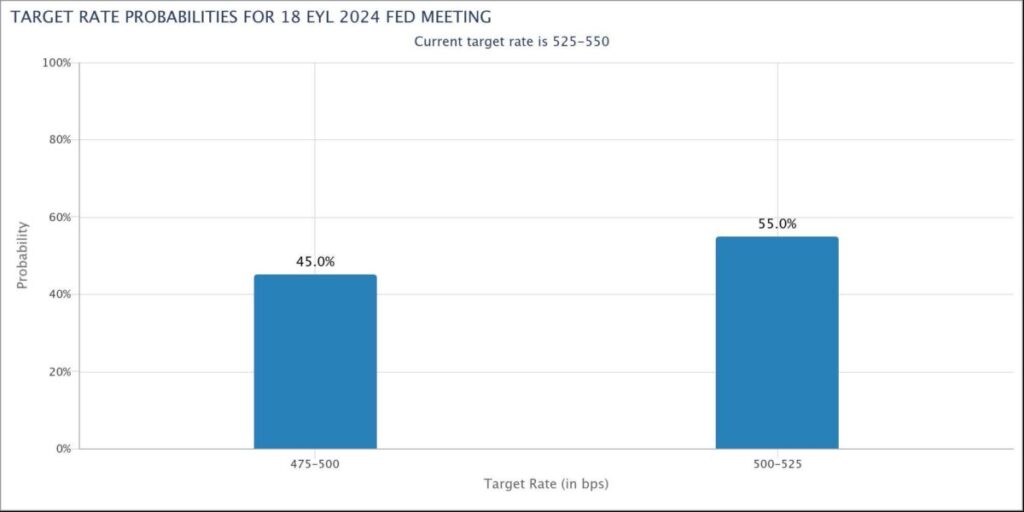

Due to the Fed’s focus on the labour market, especially after the JOLTS data, the possibility of a 50 basis point cut was suddenly priced above 50%. In the CME FedWatch Tool, which reflects the markets’ expectations for the Fed’s future interest rate decisions, a 50 basis point cut is currently priced at 45% and a 25 basis point cut at 55%.