Real Vision analyst Jamie Coutts claimed that altcoins may be close to repeating the explosive rises seen in 2020 and 2021.

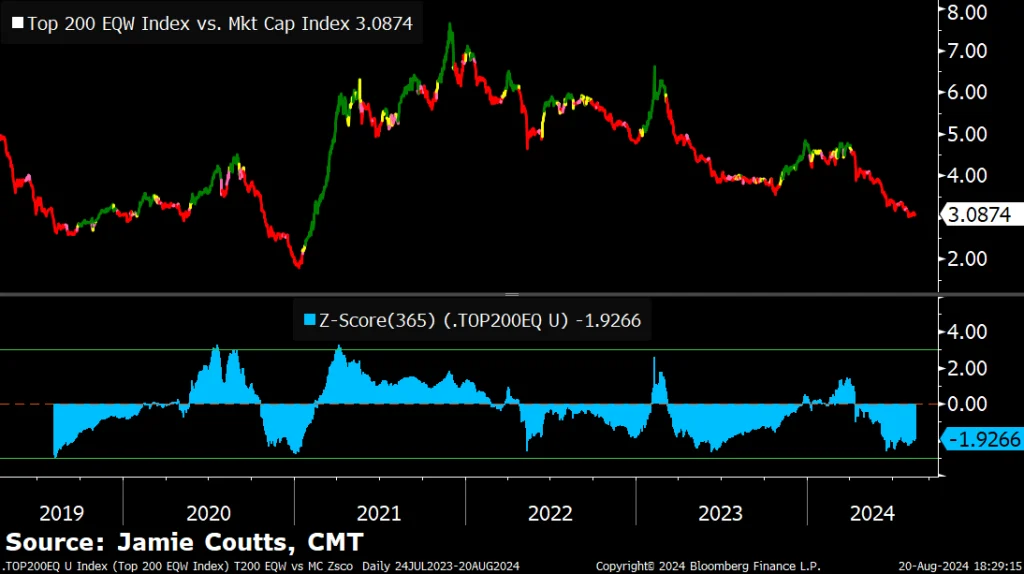

Coutts, who is also a former Bloomberg analyst, bases his prediction on a metric that compares the performance of the top 200 largest cryptocurrencies to the total market capitalisation.

The analyst wrote that the final state of the metric is similar to late 2020, when Bitcoin outperformed the rest of the market for months in terms of performance, while at the same time global liquidity increased. According to Coutts, this is a bullish sign for altcoins.

“I have posted this chart before. Chart of the top 200 Equal Weight Index (EQW) vs. Market Cap Ratio (Mkt Cap). The insane altcoin rally of 2020/21 came after severe underperformance (aka BTC rally). The setup is similar as we start to see global liquidity increase… which should drive BTC to new ATHs. BTC is lagging the global M2, which is starting to accelerate higher after a long pause.” Coutts emphasised that Bitcoin is lagging behind the global M2 money supply, which has gained upward momentum after a long break.

On the other hand, the analyst further elaborated his comments on the next altcoin cycle, claiming that ‘high-quality’ Layer 1 projects will outperform most of the market.