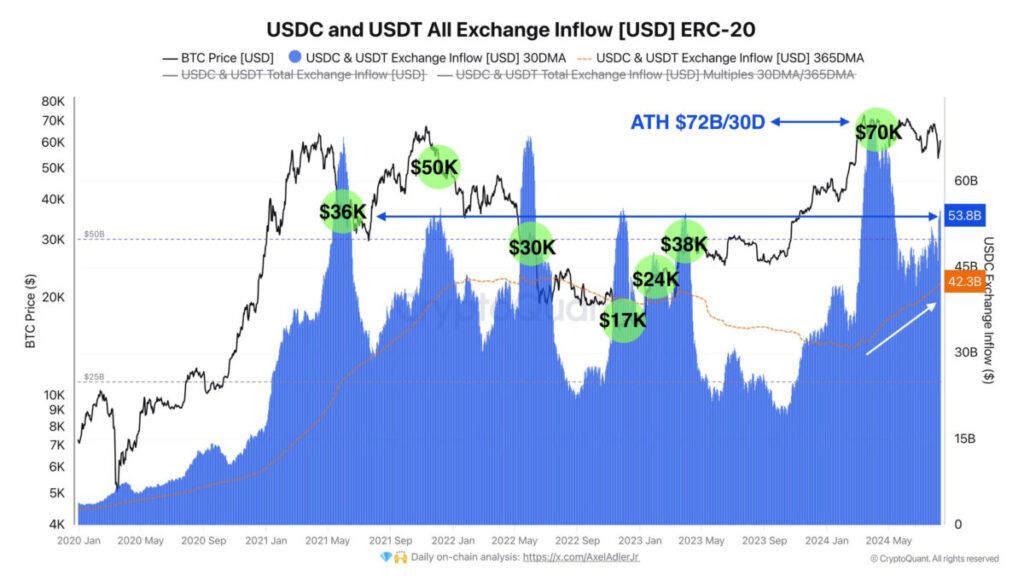

The latest on-chain data from the two largest stablecoins, USDT and USDC, shows that the average of the total value entering the stock market has reached $53 billion per day. According to the information provided by Axel Adler, an analyst at CryptoQuant, the figure has started to increase significantly in recent days.

The entry of fixed coins into the stock exchanges is seen as an increase in the likelihood of new purchases by individuals or institutions making these transfers.

“The increase in stablecoin inflow directly correlates with BTC purchases”

In the information he gave from the Adler X account, he stated that this figure was $ 72 billion in March, the last peak of Bitcoin, and said the following:

“Average monthly inflow of USDC and USDT across all exchanges equals $53 billion per day, which is above the annual average. The record inflow of $72 billion per day occurred when the price was at $70,000. The increase in stablecoin inflow directly correlates with BTC purchases.”

In the chart below shared by Adler, it is seen that these stablecoin inflows also increased during periods when the cryptocurrency world experienced very sharp ups and downs. In the 2021 bull, it is seen that fixed coin inflows peaked in May when the declines came, in May with the Terra LUNA collapse in 2022, and in March when the last peak price was seen.