Peter Brandt, who stated that he thought that the bull season would last until September 2025, when Bitcoin was on the rise in the past months, made comparisons with the past in his latest comment.

“It looks like the 2015-2017 period”

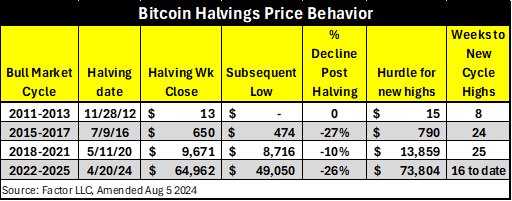

The famous analyst, who also shared a table on X, drew a similarity between past halving periods and today and said, ‘Please note that BTC decline since halving is now similar to that of the 2015-2017 Halving Bull market cycle.’

In the rightmost column of the chart below, Brandt also writes the number of weeks that each halving period must pass for new peaks in the cycle.

In the chart, which shows that 8 weeks should pass for new peaks in the halving in 2012, 24 in 2016 and 25 weeks for new peaks in the halving in 2020, it is seen that 16 weeks have passed so far in 2024. In other words, Brandt states that there is a process of about 8 weeks for new peaks to be seen here.

Another similarity between today’s halving and the halving in 2016 is seen in the rate of declines. For Bitcoin, which fell 27% to the bottom after the halving in 2016, this rate is currently at 26%. (If it doesn’t go even lower)

Bitcoin had risen 30 times after the halving in 2016

The halving in 2016 took place on 9 July of that year. Bitcoin closed the halving week at $650. At the end of 2017, the largest cryptocurrency reached a historic level for that period with $20,000. So after the halving, Bitcoin rose more than 30 times from the bottom it fell.