In addition to the launch of the Bitcoin spot ETF, Grayscale, which is waiting for the final approval from the SEC for the same product in Ether, published a report in which it shared its expectations for the 3rd quarter of 2024. Focusing more on the rise of artificial intelligence coins in the report, the company also stated that it expects the ecosystem to grow around the Ethereum chain with the adoption of Ethereum spot ETFs.

Despite the rise in Bitcoin, the crypto sector was divided into 5 main categories, especially in the report, where it was written that the altcoin ecosystem could not rise.

- Coins: Bitcoin, XRP, ZCash

- Smart Contract Platforms: Ethereum, Solana, Polygon

- Financial services: Maker, Uniswap, AAVE

- Consumer and culture: ApeCoin, Decentraland, Sandbox

- Areas of use: Chainlink, Filecoin, Lido DAO

Stating that the above areas have had a “mixed” performance this year despite the sharp rise in Bitcoin, the report noted that the same was the case in the US stock markets.

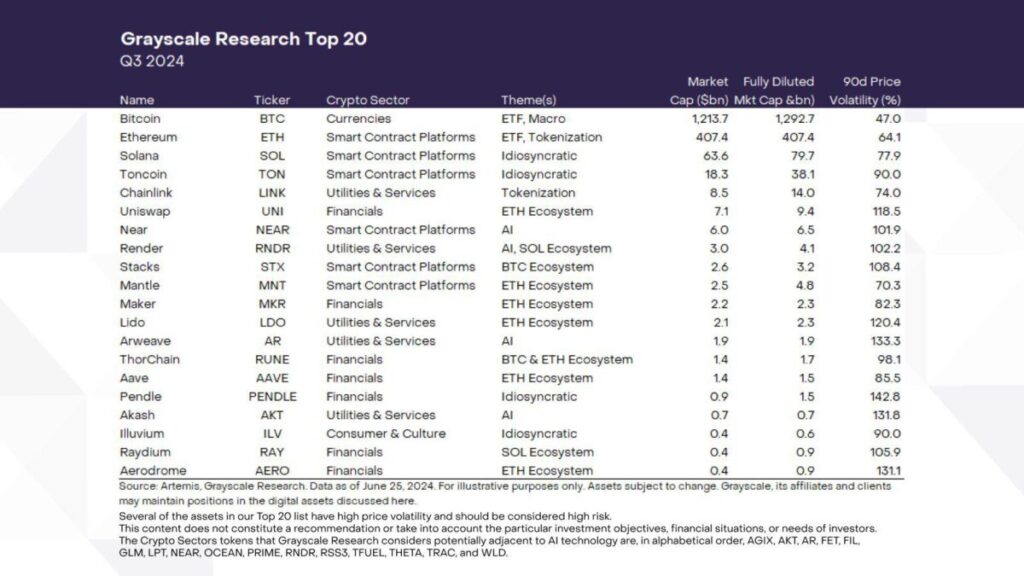

Apart from these categories, the company’s report also highlighted 18 coins along with Bitcoin and Ether. Stating that systems such as Pendle and TON make a difference with their own technologies, the report stated that excessive token unlocking in user-adaptive tokens such as Arbitrum and Optimism creates a disadvantage for investors.

Bitcoin and Ether also led the list, which includes both old and new coins of the crypto world, such as NEAR, AKT, TON, LINK, RNDR and UNI: