News during the day had a negative impact on the markets and the pressure from sellers is not yet over.

Mt. Gox announced that it will start accepting Bitcoin and Bitcoin Cash payments in July.

Of course, it is possible that this could create new selling pressure. We will wait for information on the distribution plan.

What about Bitcoin?

After a year, Bitcoin has again entered the oversold pot on the daily timeframe. The daily RSI is currently at 25-26 and as can be seen on the chart, Bitcoin has fallen to an important support level on the daily timeframe.

Bitcoin, which has been closing weekly in the range of 60 – 70 thousand dollars for several months, will face a critical test in the coming short period.

Bitcoin touched the $60,500 level, the base (support) level of the range it has been moving in for several months.

This is a level that could be a turning point that will determine whether the bleeding will continue. If it settles below it, different things will be discussed.

Ether looks a bit stronger compared to Bitcoin.

Ethereum ETFs will start at the beginning of July, and with the effect of this situation, there is an Ether that is trapped in the number 6 zone and does not break down the bottom it made in April.

This weekly close will be quite important. The next weekly candle will open in early July and the reaction to the Ether ETFs and the appetite of buyers in the coming week will determine the direction of ETH and perhaps other altcoins in the short term ahead.

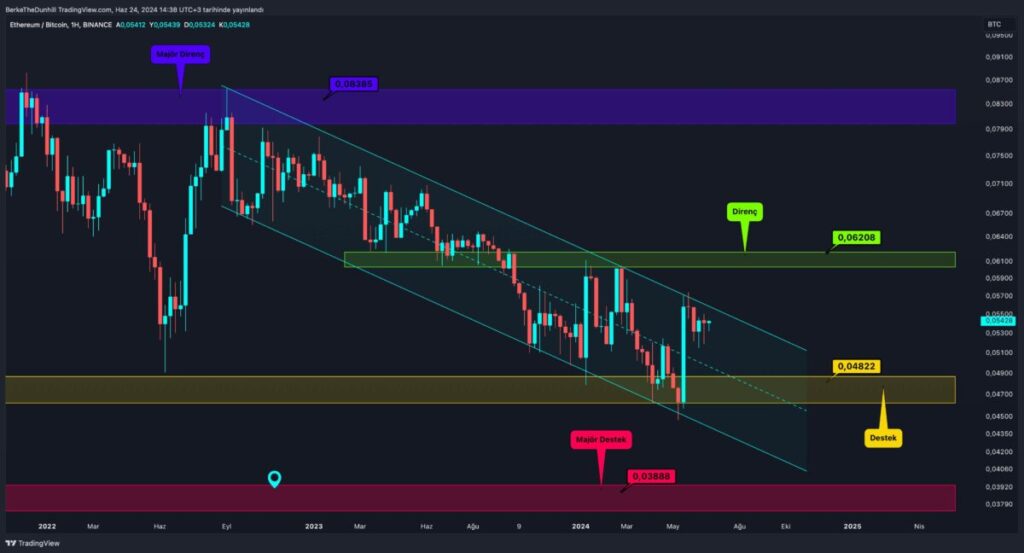

ETH/BTC has yet to break the turquoise channel in which it has been fluctuating for two years, but it has been quite strong recently.

If the 0.056 level is broken with the start of ETF trading, we can consider the two-year suppression to be over.

Of course, the most critical test for ETH will be the 0.062 level. Above this region, we can see much stronger movements for ETH.

Bitcoin dominance signals weakness.

When analyzed over longer timeframes, Bitcoin dominance has a rising wedge-like structure and there is a very obvious negative mismatch as the pair moves within this structure.

If we see Bitcoin dominance settling below the 54% level, this could herald a period that could favor altcoins.

I realize that we are in a very pessimistic environment for altcoins right now, and price action in altcoins needs to be somewhat strong for this psychology to reverse.

Many altcoins are currently in what has been dubbed a “double bottom” on the 4-hour and 1-day timeframe, and there are positive mismatches.

If the cryptocurrency market can close this week on a high note, July’s ETH ETF adventure could add some excitement to the market.

If we make a general comment, there is a cryptocurrency market that needs to stand strong this week in order to step into an environment that will make cryptocurrency investors happy in the short term.

July will also signal how we will be in the rest of the year.