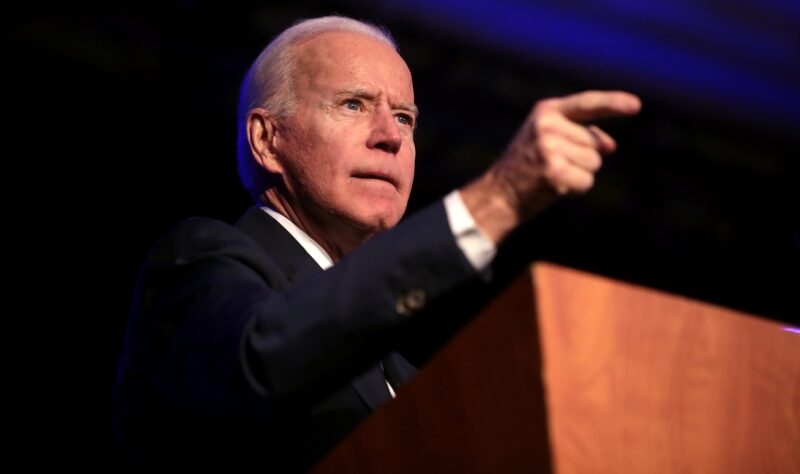

The Biden administration has announced that it will veto a proposal to override the SEC’s Staff Accounting Statement No. 121.

The notification, also known as SAB 121, makes it burdensome for banks, brokerage houses and other large financial institutions to provide custody services for cryptocurrencies. According to experts, the set of rules that require organizations that store and hold cryptocurrencies to show these assets on their balance sheets will seriously affect the financial statements and requirements of companies and prevent them from providing custody services. It is stated that this will also affect Bitcoin ETFs and banks will not be able to provide custody services for ETFs.

“By virtue of invoking the Congressional Review Act, it could also inappropriately constrain the SEC’s ability to ensure appropriate guardrails and address future issues related to crypto-assets including financial stability. Limiting the SEC’s ability to maintain a comprehensive and effective financial regulatory framework for crypto-assets would introduce substantial financial instability and market uncertainty.”

Patrick McHenry, Chairman of the House Financial Services Committee, described SAB 121 as “one of the most notable examples of the SEC’s overreach under Gary Gensler.” McHenry stated that the communiqué in question creates obstacles for banks that want to provide custody services for cryptocurrencies, and that not allowing banks to participate in the system could leave user assets vulnerable.

On the other hand, another MP Tom Emmer said, “Today, we will vote to repeal Gary Gensler’s illegal SAB 121 rule. By preventing banks from providing custody of digital assets for their customers, this rule increases the risk of concentration in our market and makes American digital asset investors vulnerable.”

The proposal to override SAB 121 is being voted in the House of Representatives as of 23.55 TSI.

Update

The bill paving the way for banks to provide custody services for cryptocurrencies was passed in the US House of Representatives by 182 votes to 228. The bill will also be voted on in the Senate and then submitted to the approval of Biden, who is expected to veto it.