Bitcoin’s sharp movements seem to have put leveraged and futures traders in the opposite corner. The movements of the largest cryptocurrency, especially yesterday, pointed to the most volatile ups and downs of the last period.

Bitcoin, which broke its historical record with $73,000, fell back to the level of $69,000 within 1-2 hours. While this decline was expected to continue, the largest cryptocurrency, which made another reverse movement, rose above $72,000 again and broke a new record with $73,650 this morning.

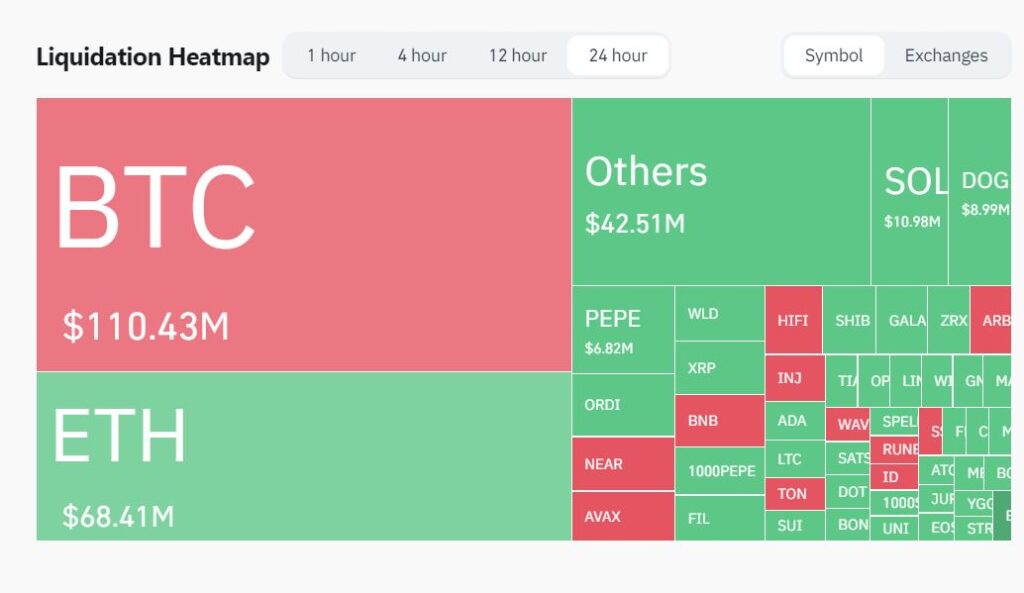

All these movements have liquidated the positions of leveraged and futures users in the last 24 hours. According to the data shared by Coinglass, $220 million of the positions liquidated in the last 24 hours were for long positions and $140 million for short positions.

Rises in the last 4 hours dispersed short positions

In Coinglass, looking at the data in the last 4 hours, it is seen that short positions have been seriously liquidated. The rises in Bitcoin, which brought the new record of $73,650, caused $32 million of short positions to be liquidated. The liquidation value in long positions is seen as $9 million.

The figures liquidated in the last 4 hours on the stock exchanges are also very large… Short and long positions totalling $19 million on OKX, $11.7 million on Binance and $3 million on Bybit were liquidated.