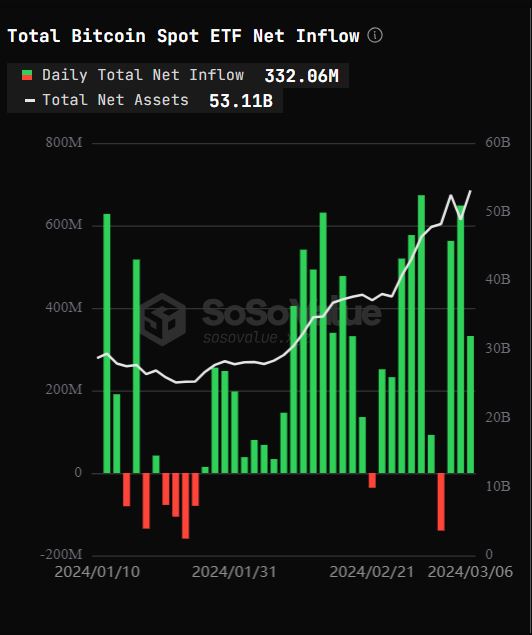

Bitcoin spot ETFs in the US seem to continue to keep the price of the largest cryptocurrency above $60,000. ETFs completed yesterday positively, as in many days. The products received a net investment of $332 million.

BlackRock is the leader again

BlackRock, which has been the leader among companies issuing Bitcoin spot ETFs since the first day, completed yesterday with $281 million after Tuesday’s record inflows of $788 million. Fidelity was in 2nd place with $205 million. Ark Invest and Bitwise received investments of $42 million and $28 million, respectively.

While the cumulative net input reached $8.98 billion, the total value of net assets, BTCs, surpassed $53 billion. The number of Bitcoins held by companies corresponds to 4.04% of the total Bitcoin supply.

Grayscale, which has made very serious sell-off since the first day ETFs opened for trading, completed yesterday with sales of $276 million. Grayscale reduces the number of BTC in its hands every day, but with the increase in prices, the total value of Bitcoins in its hands is over $27 billion.

As can be seen in the chart below, ETFs closed most of the trading days in positive territory and had the biggest share in the jump in Bitcoin price.

Bitcoin is trading at approximately $67,000 at the time of writing.