Starting a thread of its executives’ predictions for 2024, Ripple initially shared the predictions of its Chief Legal Officer Stuart Alderoty and Vice President of Product Adrien Treccani.

Both made predictions about their own businesses. Alderoty made bold predictions for 2024, especially regarding policy and US crypto regulation. Ripple’s general officer’s predictions were as follows:

- In 2024, the last bit of the SEC’s misguided lawsuit against Ripple will finally come to an end, but the SEC’s campaign of regulation by enforcement will continue against other industry leaders.

- Judges will continue to be the last line of defense against the SEC’s overreach, and the SEC will continue to lose major issues in the courts – setting the table for a showdown in the Supreme Court.

- Congress will agree in principle on crypto regulation but will disagree on the best course of action, leaving U.S. crypto firms stuck while the rest of the world makes significant positive strides.

Stating that a new paradigm has emerged as the industry tries to leave behind the problems it experienced in 2023, Treccani said, “The crypto industry isn’t courting financial institutions as it once was. It doesn’t need to. Global banks and industry giants are actively seeking digital assets solutions to satiate client demand for efficient, transparent and on-demand financial services. In the last year, we’ve announced partnerships with several global banks, and in 2024 we expect adoption rates to continue to soar. Banks are experimenting with tokenized assets, and need to be able to do so with confidence, inside the framework of strict compliance and security protocols, as well as smooth integrations.”

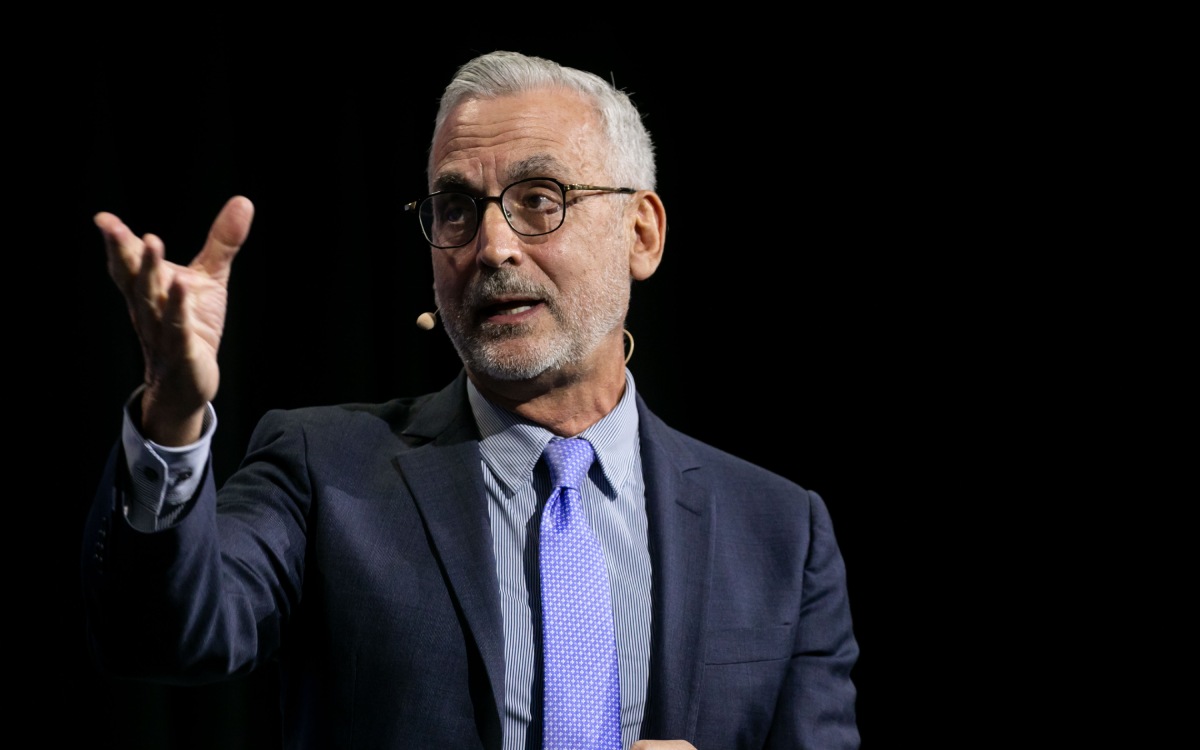

Photo by Michael Nagle/Bloomberg via Getty Images